Sethu and Raji were a loving couple. They had come through the rigors of life and had almost dedicated their entire life for their children. The kids were decently settled and now the couple were through with their lives responsibilities to others. The only thing they had for themselves was their house which they had bought saving penny by penny. This was one of their special days in their life and at the same time a scary one too. Sethu had reached the twilight of his career and this was the last day in office for him. Since he had borrowed from his savings for kids education, marriage etc. there was hardly anything left which he was taking as his retirement benefit. The company did not offer any pension scheme either. As they ate their last dinner this sudden realization dawned on them. The interest on his investment hardy worked out to a few thousand rupees which would not be enough to sustain them. They did not want to burden their kids either. The only thing that was left as an asset was their house. Tears filled their eyes as they contemplated on selling it to sustain themselves or he might have to find a job again which was doubtful at this age. Now retirement was being a heavy burden on the couple as they retired to their bed with fear in their hearts.This is a common story of most middle class couples in our society. For some who have managed to own a property there is some good news.

REVERSE MORTGAGE:SBI has finally launched this scheme for senior citizens which allows them take a personal loan by mortgaging their property. This scheme removes the burden of earning for a living after retirement and also to retain the hard earned property.

Conditions:

- You have to be 60+ years

- Should have only one wife/husband who is 58+ years

- Should be using the premises for your residence

- Own the clear title to the property without any encumbrances

- Balance life of the property should be minimum 20 years on the date of availing the loan.

- Maximum loan period up to 15 years if you are 68 years & 10 years if you are above 68 or death whichever is earlier

- Loan+Interest can be availed to up to 90% of property value based upon prevailing market rate.

- Loan can be availed as monthly payment, quarterly payment or as a lumpsum payment.

- Interest @ 10.75% flat.

- Maximum loan of 1 crore and minimum of 3 lacs.

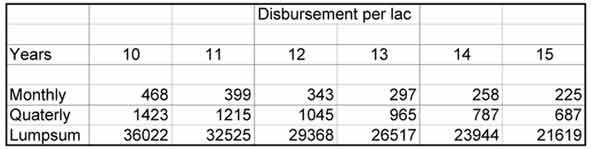

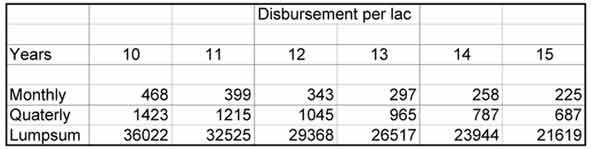

For example, if you have a property worth 10 lacs, then @90% you avail a loan of 9 lacs which compounded for 15 years at 10.75% would work out to Rs. 225 per lac per month = 225x9 = Rs. 2025 per month or Rs. 687 per lac per quarter = 687x9=Rs. 6183 per quarter or a lumpsum of Rs. 21619 per lac or 21619x9=Rs. 194571. Monthly or quarterly receipt is more attractive and sustaining than lumpsum payment.

There is no prepayment penalty and hence at any time in case of an emergency or a major appreciation in property which you may want to capitalize, you can sell the property and repay the loan and get the balance to your account.

Benefits:

1. Your house fetches you a fixed income every month and you continue to enjoy the property.

2. The interest you pay is more than compensated by appreciation in property value.

3. Since it is a fixed interest rate you are covered by future hike in borrowing rates.

4. You cover for your spouse by this income after your death.

5. In India the unofficial market rate is always higher that the official market rate by atleast 25%, hence you are always covered by this factor in case of a distress sale.

Some of the risks of such an arrangement would be

1. Fall in borrowing rates below 10.75% owing to economic conditions.

2. Drop in property value which will then need a reassessment of loan to your disadvantage.

3. You will have to continue to stay in the premises and cannot let it out.

4. You will need to maintain on home insurance every year and upkeep the premises even for minor repairs.

5. In case of any disputes within the family can lead to problems with the bank stopping and canceling the loan agreement.

Prevailing real estate market conditions in India, especially in the metros are positive and the property values are likely to keep booming owing to more demand than supply. Under the prevailing conditions this kind of mortgage should be beneficial especially if the value is upwards of 30 lakhs.

@30 lakhs the monthly earning would be Rs. 6075 for a 15 year period and Rs. 12636 for a 10 year loan period.

See the chart below